In a major escalation of trade tensions, the Trump administration has imposed new restrictions on Mexican airlines and is threatening to dissolve the long-standing Delta-Aeromexico partnership. The move follows years of contention over Mexico’s controversial airport policies and is expected to affect millions of travelers and billions in economic activity.

🛫 Background: What Sparked the Clash

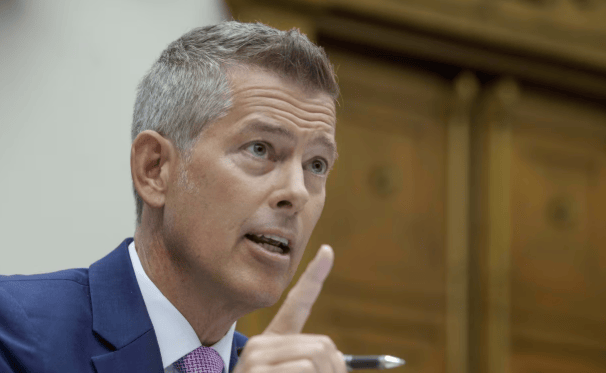

Transportation Secretary Sean Duffy announced the restrictions Saturday, citing Mexico’s decision to force airlines to shift flights from Mexico City’s main hub, Benito Juarez International Airport, to the newer, less connected Felipe Ángeles International Airport — located more than 30 miles from the city center. Duffy said the policy violated the U.S.-Mexico bilateral aviation agreement and unfairly favored Mexican carriers.

“Joe Biden and Pete Buttigieg deliberately allowed Mexico to break our bilateral aviation agreement,” said Duffy. “That ends today… America First means fighting for fairness.”

✈️ What the New U.S. Restrictions Entail

All Mexican passenger, cargo, and charter airlines must now submit their flight schedules to the U.S. Department of Transportation (DOT) and receive explicit approval before operating. This unprecedented measure effectively places a bureaucratic barrier on flights into the U.S., pending compliance from the Mexican government.

These moves come as over 40 million passengers traveled between the two countries in 2024, making Mexico the top foreign destination for American travelers.

Mexico’s Response? Radio Silence So Far

Mexican President Claudia Sheinbaum has not yet responded publicly. Her administration remained silent on Saturday despite two public appearances. Requests for comment from her office were not returned.

The Delta–Aeromexico Partnership Under Fire

The DOT also announced a tentative order to terminate its 2016 approval of the Delta-Aeromexico joint venture. That alliance currently supports nearly two dozen U.S.-Mexico flight routes and is estimated to provide $800 million in annual economic benefit through tourism and job creation.

Delta responded strongly:

“Terminating this strategic and pro-competitive partnership would harm consumers, U.S. jobs, communities, and transborder competition.”

Aeromexico stated it is reviewing the order and will issue a joint response with Delta soon. The DOT’s final decision on the partnership is not expected to take effect until October, leaving room for legal and diplomatic maneuvering.

📉 What’s at Stake Economically

According to Delta and Aeromexico’s joint filing, an end to their partnership could:

Cause the loss of 140,000+ U.S. tourists visiting Mexico annually.

Prevent nearly 90,000 Mexican travelers from visiting the U.S.

Disrupt over $800 million in tourism-related economic activity.

The Bigger Picture: Trade War Brewing?

The aviation dispute comes amid broader trade friction between the U.S. and Mexico, as the Trump administration pushes harder against trading partners it accuses of exploiting American markets. Whether these flight restrictions will ripple into other sectors — like auto manufacturing, agriculture, or energy — remains unclear.

What’s Next

Airlines will likely challenge the DOT’s moves in court or through lobbying.

The Biden administration's role in allowing Mexico’s original airport transition policy is likely to remain a campaign flashpoint.

Expect significant pressure on President Sheinbaum to respond diplomatically or economically.